41+ can i use my 401k to pay off my mortgage

When you retire you have a few options for your old 401k see them here. Web Cashing out your 401 k and using the proceeds to pay off your mortgage lets you borrow at a low rate and invest at a high rate and do so at no risk.

Paying Off My Mortgage Vs Investing In My 401 K

Web If you arent fully funding your retirement accounts then you shouldnt be considering an early mortgage payoff says James Kinney a certified financial planner in Bridgewater.

. Web If you dont file or pay the 05 failure-to-pay penalty will accrue up to 25 of what you owe until the tax is paid. Save Real Money Today. Save Real Money Today.

If you take money out of a 401 k before youre 59½ that amount is also typically subject to a 10. Paying off your mortgage. 401k Rollover Penalties When you roll over your 401k and take a cash.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad Explore Different Ways To Help Pay Off Credit Card Personal Or Loan Debt In 2023. Web This is true whether you make a withdrawal at 29 59 or 79.

But if youre already in a low-interest rate mortgage and. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Ad Open an IRA Explore Roth vs. Web Paying off your mortgage before retirement will also reduce your retirement expenses as lowering them is crucial. He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that.

That means the total penalty for failure to file and. Some might decide to cash out a. Here Are The Best Apps To Help Pay Off Debt In 2023.

Web Using your retirement savings to make mortgage payments could also trigger taxes. Paying off your mortgage early. If you withdraw 60000 from your IRA to pay off your mortgage you.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web However penalties apply if you take a cash distribution of your 401 k to pay off your mortgage. Traditional or Rollover Your 401k With T.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Get Started Today and Build Your Future At A Firm With 85 Years Of Retirement Experience. Web Heres a look at more retirement news.

You can use your entire 401. Explore For Free Today. Web Withdrawing the funds puts your retirement savings at risk or forces you to make drastic changes in your lifestyle.

Cashing out your 401 and using the proceeds to pay off your mortgage lets you borrow at a low rate and invest at a high rate and do so at no risk. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Web After you leave your job the Internal Revenue Service rules dont restrict when you can withdraw money from your 401 k account.

Web Paying off the mortgage with a 401k.

Should I Cash Out My 401 K To Pay Down My Mortgage Youtube

How To Pay Off A 401k Loan Early The Budget Diet

41 Flohmarkt Tipps Ideen Flohmarkt Tipps Flohmarkt Tipps

:max_bytes(150000):strip_icc()/GettyImages-1166987219-69a5b981ab0946a4a7a90a6b3395c11a.jpg)

Using Your 401 K To Pay Off A Mortgage

Bill Organization Get Some Much More With These 2 Money Systems

Should I Pay Off My Mortgage With My 401k Quora

:max_bytes(150000):strip_icc()/GettyImages-905523822-6ce8d6962dc5413294e395ee3d3890f1.jpg)

Using Your 401 K To Pay Off A Mortgage

Can You Make Extra Payments On A 401 K Loan To Pay It Off Faster

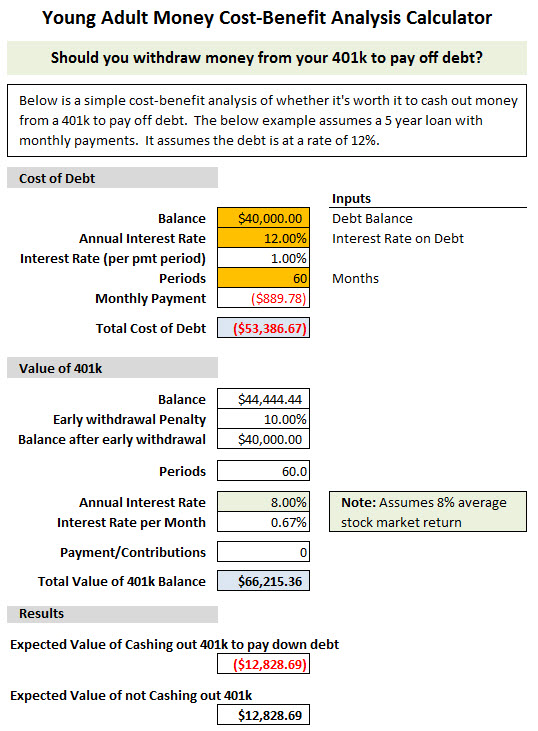

Should You Cash Out Your 401k To Pay Off Debt Free Calculator Download Young Adult Money

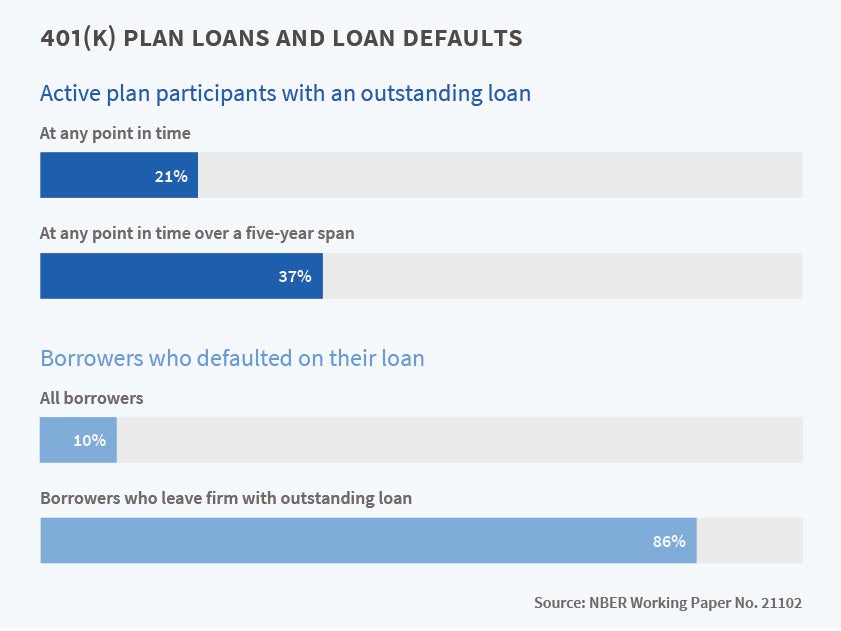

Borrowing From 401 K S Nber

Should I Clean Out My 401 K To Pay Off My Mortgage Fox Business

Should I Pay Off My Mortgage With Money From My 401 K The Washington Post

Should I Pay Off My Mortgage With My 401k Quora

The Iola Register June 3 2020 By Iola Register Issuu

Why You Shouldn T Use Your 401 K To Pay Off A Mortgage

Tax Loopholes For Paying Off House With 401 K

Tax Loopholes For Paying Off House With 401 K